Google has said that it will extend Android Pay to the UK “in the next few months.” The service allows any device running Android 4.4 or higher and fitted with an NFC (near field communication) chip to act as a tap-and-pay substitute for credit and debit cards. Several lenders, including Lloyds Bank, HSBC, and Nationwide have said they will support the scheme.

Samsung earlier said its rival service would also come to the UK this year. The South Korean handset maker has yet to be more specific about its British launch plans for Samsung Pay, which is restricted to its own Android smartphones. Apple Pay has been available in the UK since July 2015 but is limited to the firm’s iOS devices, so will not compete directly with Google’s service. At present, Android Pay is only available in the US, where it became available in September.

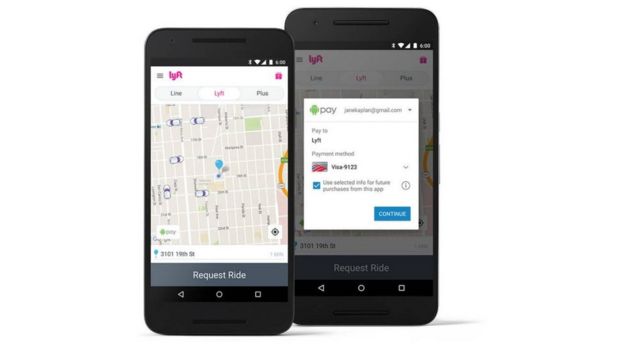

A Google spokeswoman said it was now “likely” that the UK would become its second market. The only other expansion plan announcement has been about bringing Android Pay to Australia by the end of June. The service requires a user to first store details of their cards within the app, and then provide a fingerprint scan or passcode to authorise a payment. It can be used in stores and restaurants as an alternative to tapping a card on a point-of-sale terminal, or within apps to avoid having to type in account details.

In theory, it is safer to use than a physical credit or debit card as the owner does not need to reveal their account number at point of purchase, and even if someone was able to intercept the transmitted encrypted information, they could not re-use it to authorise further payments.

Google said it had struck deals with Visa and Mastercard to allow the service to stand in for their cards, as well as several UK’s financial institutions including:

- Bank of Scotland

- First Direct

- Halifax

- HSBC

- Lloyds Bank

- M&S Bank

- MBNA

- Nationwide

That still leaves several big names missing, including American Express, Barclays, Royal Bank of Scotland and Santander – but Google said it intended to add more organisations to the list ahead of the launch.

Many stores in the US are still moving from magnetic strip-based terminals to chip-and-pin systems, which gives Samsung another advantage as its system works with both. It is a different case in the UK, where chip-and-pin has been the de facto standard for several years. One industry watcher said that while in-store payments were a useful feature, it was Android Pay and other digital wallets’ in-app functions that should drive their adoption.

Are you excited about using Android Pay in the UK? Tell us what you think in the comment section below or on Google+, Facebook, or Twitter.

[button link=”http://officialandroid.blogspot.com/2016/03/tap-pay-uk.html”icon=”fa-external-link” side=”left” target=”blank” color=”285b5e” textcolor=”ffffff”]Source: Official Android Blog[/button]