The following is an editorial, these are my thoughts on NFC vs CurrentC, these thoughts are my own.

Google tried to introduce a new form of paying at the register when it introduced Google Wallet on NFC capable phones back in 2011. Since then only a small number of users even know what Google Wallet is, and an even smaller number know what NFC is. Fast forward to 2014 and Apple decides that NFC payments might actually be a good thing and they make their iPhone 6 line NFC payment capable. Suddenly the mainstream media is reporting the wonders of Apple Pay and NFC in the latest iPhones.

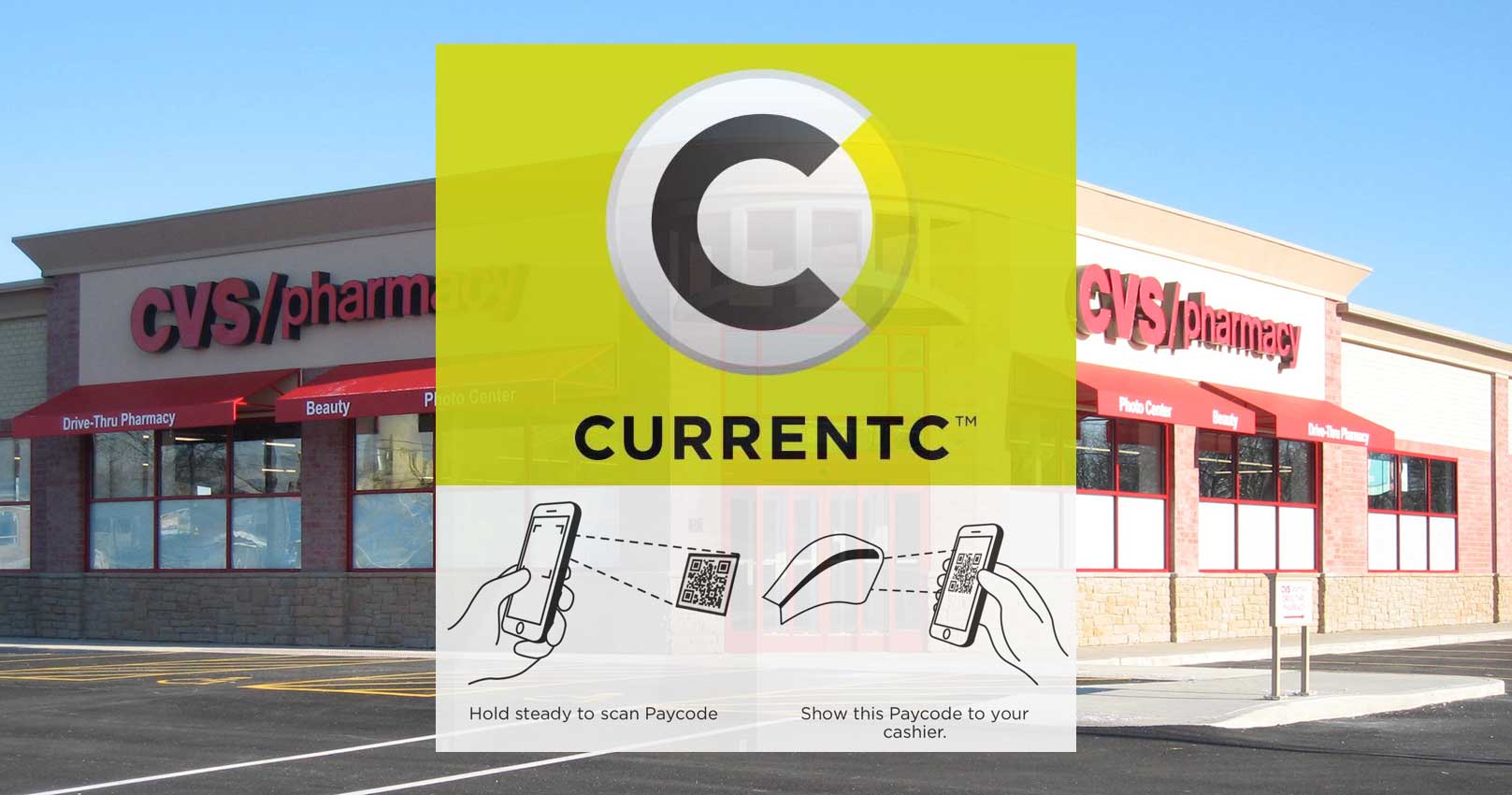

Now the whole world knows exactly what NFC and mobile payments are. Good news for Google Wallet and other NFC payment ventures right? Wrong. Turns out the big box retailers have been dreaming up their own mobile payment system called CurrentC in order to get out from under the credit card industries 2% transaction fees. CurrentC uses QR code scanning to accomplish a transaction at the register, the problem with that is, it’s clunky and not at all user friendly.

When it’s time for a user to check out, they request to pay with CurrentC. The consumer then unlocks their phone, opens the CurrentC app, opens the code scanner, and scans the QR code shown on the cashier’s screen. In some case, the reverse may happen where the consumer’s CurrentC app displays a payment code and the cashier scans it. If a QR code can’t be generated, a manually entered numeric code may be offered.

With NFC payments you simply tap your phone and use TouchID on your iPhone to complete the transaction. On Android it’s about the same, tap the phone and in some cases enter your pin. Clean and simple, no scanning one code then another and showing your phone to the cashier. CurrentC is being used by the big retailers to increase profits by getting out of the fees Visa, MasterCard, AMEX and others charge them. The user experience is not first on their minds, making their payments system work for you is not on their agenda. There’s talk of retailers offering incentives like coupons and discounts if you use CurrentC, of course these will be small loss leaders compared to the amount of money they will gain back from skirting credit card fees. Recently it was revealed that CVS Pharmacy yanked the ability to use Apple Pay (or any NFC payment system) from its stores. Wonder why? Because CVS Pharmacy is backing CurrentC and they don’t want Apple Pay or Google Wallet competing inside their stores giving you the user one less option. Below is a list of some of the other retailers committed to CurrentC.

As you can see the list is extensive and there are major names looking to increase their profits first and provide a good user experience second. While it’s understandable that these companies want to get out of paying fees to big credit, they’re doing it by using a clunky unintuitive payment system. Not only that, they’re taking choice away from the consumer by not allowing Apple Pay, Google Wallet or any NFC payments to be used. TechCrunch has an extensive write up on their site I encourage you to read, they delve deeper into what CurrentC and NFC are and how they differ and why these retailers are itching to make it their default electronic payment system. What do you think of CurrentC? Let us know in the comments below or on Google+, Facebook and Twitter.

Update: I’d like to add this bit of goodness from a user on Google+ David Jao, thanks for pointing this other glaring issue with CurrentC. You can find his comment and discussion on Google+.

The problem with CurrentC is not the technical protocol. I could care less whether they use QR codes or NFC or tokens. The problem is the legal status. CurrentC is not based on credit cards, which by law limit consumer liability in the event of a security breach. With CurrentC, there are no laws or regulations limiting consumer liability in the event of a security breach. It’s just the retailer against the consumer. Guess who wins?

I will never support any payment system that exposes the consumer to 100% legal liability. Apple Pay and Google Wallet are based on credit cards and offer much stronger legal protections.

[button link=”http://techcrunch.com/2014/10/25/currentc/” icon=”fa-external-link” side=”left” target=”blank” color=”285b5e” textcolor=”ffffff”]Source: TechCrunch[/button]

Last Updated on November 27, 2018.

Comments are closed.