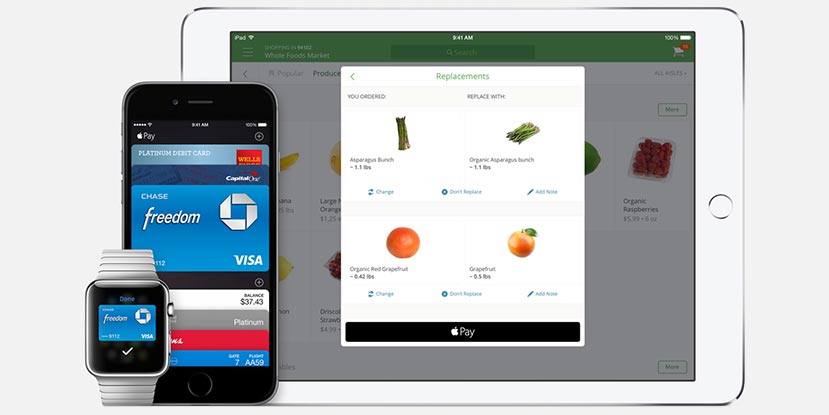

According to the Wall Street Journal, Apple Pay is set to make its debut in Canada this fall, potentially in November. Apple Pay is Apple’s mobile payment service that allows users to make credit and debit card purchases by simply tapping their iPhone or Apple Watch on machines equipped with NFC capabilities. While Canada’s six biggest banks – including Royal Bank, TD, CIBC, Bank of Montreal, Bank of Nova Scotia, and National Bank of Canada – are currently in negotiations with Apple, sources say that the banks are unhappy with Apple’s fee proposals and have some security concerns with the service.

Canada has long been a leader when it comes to credit and debit payments, and a large majority of business in that country already utilize contactless payment terminals. Coupled with recent research that indicates iPhones account for roughly one-third of Canadian smartphone usage (compared to around 20% globally), it makes sense for Apple to roll out the service in Canada next after first introducing it last October in the U.S. A few banks in Canada, like TD, already offer contactless NFC mobile payments for some devices so this would be a logical extension of offering mobile payments to more users in the country which use the newer iPhone 6 or 6 Plus which are equipped with mobile payment capabilities.

Sources indicate that Canada’s “six banks” have an issue with the terms of the commercial agreement as they believe they will be facing hire costs to implement Apple Pay than what their U.S. counterparts have. As these banks account for nearly 90% of Canadian banking customers, they certainly have the leverage to negotiate with Apple if Apple wants to see Apple Pay launch and be successful in Canada.

Security is also an issue due to some early bumps with the U.S. rollout, and as a result the Canadian banks have hired the services of the management consulting firm McKinsey and Co. to assist with developing security protocols for use with Apple Pay. While mobile payments are meant to be fast and painless, sources say that the Canadian banks want to implement a secondary authentication method such as entering a PIN, logging into a mobile app, or using a one-time passcode before the payment will be accepted. Interestingly enough, most banks in Canada already allow tap and pay services which simply require a tap of a credit or debit card without entering a PIN or secondary authentication. TD Bank, for example, also allows Android and Blackberry users to make purchases of up to $100 with an NFC enabled cell phone in the same way by simply holding their smartphone over the terminal and select which account to make the payment from. Consumers used to these one-step methods might not be as quick to jump on board with Apple Pay if a secondary step is introduced into the process.

Do you currently use some form of mobile or card tap payments in Canada? Let us know if you’d use Apple Pay if it were to launch up here in the comments below, or on Google+, Twitter, or Facebook.

[button link=”http://www.wsj.com/articles/apple-pay-plans-to-launch-in-canada-this-fall-1429280816″ icon=”fa-external-link” side=”left” target=”blank” color=”285b5e” textcolor=”ffffff”]Source: Wall Street Journal[/button]Last Updated on November 27, 2018.