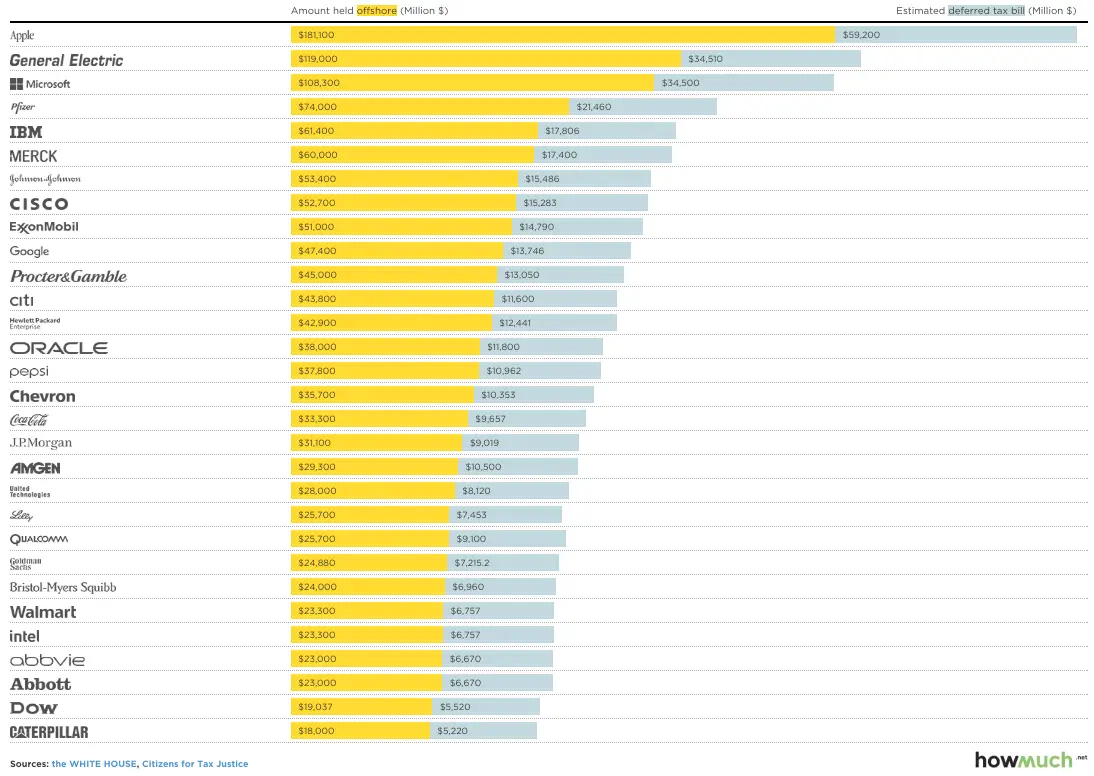

Benjamin Franklin famously said, “Nothing is certain except death and taxes.” and for ma and pa Jones that is true. But the corporate truth behind taxes is companies find loopholes in the code to avoid them. Howmuch.net has a chart out now that shows just how much some U.S. companies are holding in overseas assets and how much tax that would generate here. The numbers are high as you would expect, and big tech companies account for 5 of the top 10 biggest culprits of tax evasion. Apple, Microsoft, Google, IBM and Cisco hold a collective $450 million dollars in off shore assets which amounts to $93 million in deferred tax.

It’s easy to call out the top dog on this chart, Apple, and complain how they’re getting away with not paying taxes and they should be punished. But let’s not let fanboy blinders get in the way. Microsoft and Google are in the top 10 as well. It doesn’t matter what position, the fact is they are. This really isn’t anything new though, companies have been finding tax shelters for as long as governments have wanted to tax them. Howmuch.net also has a bullet point list that maps out what the U.S. could do with these tax dollars if it was able to collect them from the listed companies above.

- For instance, Apple’s deferred taxes would have paid for more than two-thirds of the federal budget for Education, Training and Employment (67.4% to be exact)

- Social Security is a gigantic cost for the federal government. Still, General Electric’s deferred taxes alone would have paid for 1/25th of the total (i.e. 4%)

- If Microsoft had kept all its assets in the U.S., the taxes thus generated would have covered one-fifth of federal spending on Veterans Benefits and Services (20.8%, actually)

- The deferred taxes of pharmaceutical giant Pfizer would have covered almost nine-tenths of the federal budget for Agriculture (87.7%)

- IBM’s deferred taxes represent almost a third of what the federal government spends on the Administration of Justice (32%)

- Google’s deferred taxes are equal to 1.5% of the federal budget for Health and Medicare.

- ExxonMobil’s deferred taxes would have paid for a quarter (25.7%) of the federal budget for International Affairs.

- Oracle’s deferred taxes are equal to just over 40% of the federal budget for Science, Space and Technology.

- Pepsi’s deferred taxes amount to just over twice the federal budget for Energy (201.8%).

- Even Caterpillar, the last company on the list, still defers taxes equal to more than one-eighth (13.8%) of the federal budget for Natural Resources and Environment.

But let’s step back for a minute. If the U.S. government were able to collect all of this tax from these various companies. Do you really think the majority of that money would actually go to pay for the things listed in Howmuch.net’s bullet points? While it’s a warm fuzzy thought to have and it’s probably what most of would want to see happen. The harsh reality is, political greed doesn’t fall too far from corporate greed. Either way, collected or not, we as a people aren’t likely to see a dime of good come from it.

How do you feel about companies finding tax shelters? Do you think the U.S. government would actually put the funds to good use if it was able to collect? Let us know your thoughts in the comments below or on Twitter, Facebook and Google+.

Last Updated on January 23, 2017.