Bitcoin is the first decentralized digital currency that uses peer-to-peer technology for facilitating transactions. Bitcoin has been making headlines since 2018, when its price rose from $7000 to $30,000 in less than a year. Currently, it’s priced at ~$50,000 after it touched new heights at $58,000 a week back.

It was created back in 2009, and it’s still going strong even when most governments, banks, financial institutes criticized it for being too volatile or an inefficient way of transacting.

Despite constant and harsh criticism, it has not stopped businesses from accepting Bitcoin payments. Giants like Microsoft, AT&T, Wikipedia, Burger King, KFC, Subway, and more are on the list of such businesses. The list is quite big. In the recent news, Tesla invested $1.5 billion in Bitcoin and announced that they would accept Bitcoin payments for their high-end electric vehicles. We can expect PayPal to enter the cryptocurrency game soon, which will only boost Bitcoin usage for business transactions.

Over 100,000 merchants worldwide already accept Bitcoins as payments. A third of SMBs, i.e., 36%, accept Bitcoin payments, while 59% of them have personally traded in Bitcoins for personal use.

So, if you’ve been contemplating whether to accept Bitcoin payments, then this blog will help you understand the pros and cons of Bitcoin payments. Then you can make a rational decision with the right facts.

Let’s start with the pros (benefits) of accepting cryptocurrencies like bitcoin as payments for your small or medium-sized business.

Benefits of Accepting Cryptocurrencies like Bitcoin as Payments

Little to no transaction fees

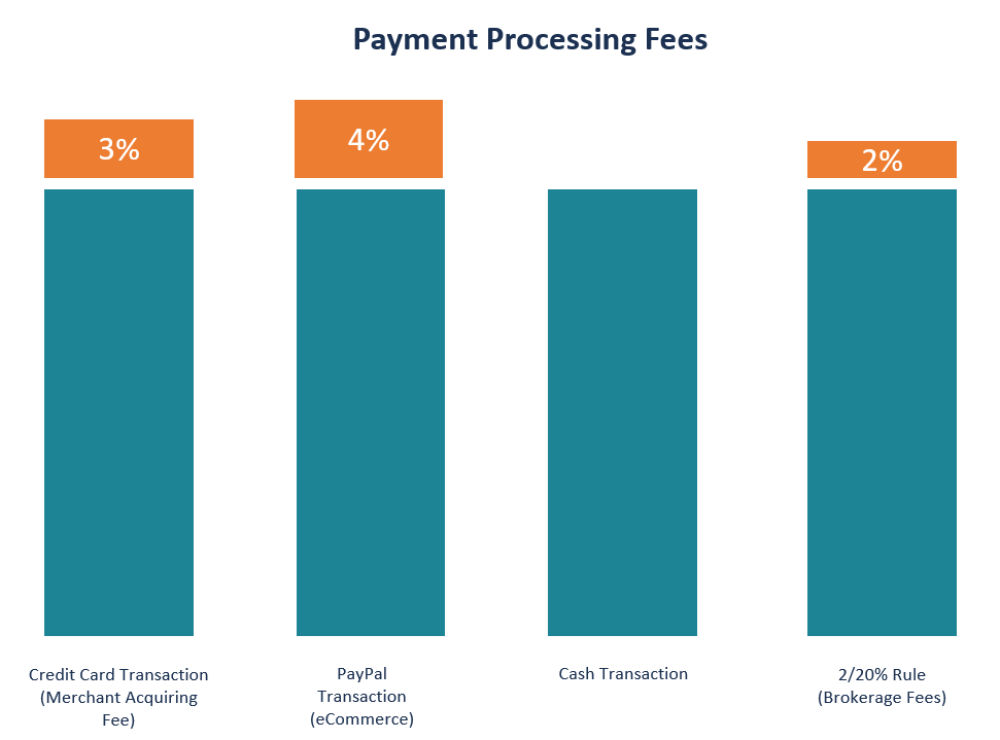

For electronic transactions, businesses end up paying 0.5% to 5% of the total transaction as processing fees to the payment service providers. The transaction fees vary for businesses based on their preferred pricing model and the risk associated with the transaction.

Here’s an overview of the transaction fees:

On the other hand, Bitcoin and other cryptocurrencies charge little to no transaction fees. The transaction fees usually vary based on the data exchanged and network congestion – so if there’s a surge in transactions, you might have to shell out a little more but that’s nothing compared to ~3% you pay for every customer transaction. Many cryptocurrencies don’t even charge any transaction fees.

Globally acceptable

Except for a few countries like Russia, China, Vietnam, Bitcoin is globally accepted and legal. Here’s the list of countries it’s an acceptable form of payment. If you cater to a global audience, then Bitcoin will be a more cost-effective mode of payment transaction as compared to the other financial service providers.

So, if your suppliers and customers are trading in Bitcoin, then it’ll be a better, cheaper, and transparent form of financial exchange for your business.

Swift transactions

Since there are no banks or third-party services involved in transactions, one layer of processing and checking gets eliminated, making Bitcoin transactions swift. The crypto networks process your transactions which are extremely secured and based on blockchain technology and more importantly, they don’t need to wait around for financial institutes to process or check every transaction.

No setup cost

To accept Bitcoin payments, you’ll need to set up a point-of-sale app like BitPay, CoinGate, etc. These apps usually don’t charge any setup costs or recurring fees.

You’ll just need to

- download their apps on your device

- enter the amount in your currency which will be automatically converted into Bitcoin

- a QR code will be generated

- your customers can scan it using their wallet apps to make the payment.

And boom. The Bitcoin payment will be in your wallet within a few seconds. If you’ve opted for a money transfer to your bank account, then the payments will be in your account the next working day.

Additional business from the Bitcoin economy

The value of Bitcoin keeps fluctuating, but mostly it goes up. As mentioned above, last week it touched a new high of $58,000, and currently, it’s being traded above $50,000. This goes to show that when you accept Bitcoin payments, you are essentially accepting an appreciating asset that can earn you more in the future. For example, if you accepted 0.0024 ($121.16) Bitcoins in exchange for goods and services when it was valued at $50,000 and its current trading rate is $52,000, then your $121 becomes ~$124.

The appreciated value of $3 becomes your additional business from the Bitcoin economy.

No fraudulent chargebacks

Credit card transactions are prone to fraud. Around $9.47 billion were lost in fraudulent credit card transactions in 2018.

Contrarily, cryptocurrencies come with business protection. Its decentralized system protects businesses from fraudulent chargebacks, i.e. all the transactions are final and irreversible. It’s as good as having cash in your hand.

Additionally,

- Bitcoin payments not only help you cater to customers who prefer such payments but also adds an extra layer of protection to your transactions.

Cons of Accepting Bitcoin Payments

Technical limitations

For bitcoin payments, the business owners need to set up digital wallets and POS apps which are a bit on the technical side. This can come across as a barrier for small business owners who might not be so technologically advanced. Additionally, cryptocurrency has a high learning curve that requires business owners to be on their toes, which can be hard when you are running and growing a business.

It’s a small glitch but extremely rewarding.

Price volatility

This can be considered a pro as well as a con. As mentioned above, you can earn extra if the prices go up, but then again it can easily go down as well. Such price volatility can present itself as a major hurdle for your business as it directly affects your revenue.

According to Areiel Wolanow, managing director of consulting firm Finserv Experts, the business owners need to make some form of arrangement for translating their cryptocurrency back into your currency of record and it needs to be quick and regular.

The POS apps provide businesses with the feature of immediately transferring Bitcoins in their bank accounts at their cash value.

Uncertainties in Regulations

Governments and financial institutes have just started embracing cryptocurrencies, which means that the regulatory landscape can experience some changes in the near future.

Your Call

Bitcoin and other cryptocurrencies are set out to make other forms of exchanges obsolete. However, for investing in a right type of cryptocurrency thorough research is necessary besides understanding the nuances of the market. To this end, research platforms like Crypto investor network provide extensive research services and help navigate the market by pointing towards the flourishing trade opportunities. That said, soon cryptocurrencies are going to transform the traditional currencies by disrupting the market. It’s always better to ride with the waves than catch up later when it’s too late.

What are your thoughts? Let us know what you think on our MeWe page by joining the MeWe social network or by commenting on our other social media pages.